QR-based Payment System Service Providers (PJSP) are required to use QRIS since January 1.

Since August 2019, Bank Indonesia (BI) has implemented Quick Responds (QR) Code Indonesia Standard (QRIS) international standard. QR-based Payment System Service Providers (PJSP) are required to use QRIS since January 1, 2020. All transactions via barcodes are now carried out nationally according to QRIS.

The implementation of QRIS is to ease transaction process and increase financial inclusion in Indonesia. In addition to ease transactions, the implementation of QRIS for Payment System Service Providers is also to prevent the occurrence of business monopolies which have been feared. So, all Payment System Service Providers can read each other, including foreign-owned Payment System Service Providers.

PJSPs (including foreign PJSPs) who do not implement QRIS will be sanctioned by BI. This has been regulated in Regulation of Members of the Board of Governors (PADG) No. 21 of 2019 concerning the Implementation of Quick Responds (QR) Code Indonesia Standard for Payment.

BI’s QRIS carries the spirit of UNGGUL (UNiversal, GampanG, Untung, and Langsung) which means:

1. UNiversal

The use of QRIS is inclusive for all people and can be used as a payment instrument both in Indonesia and abroad.

2. GampanG (Easy)

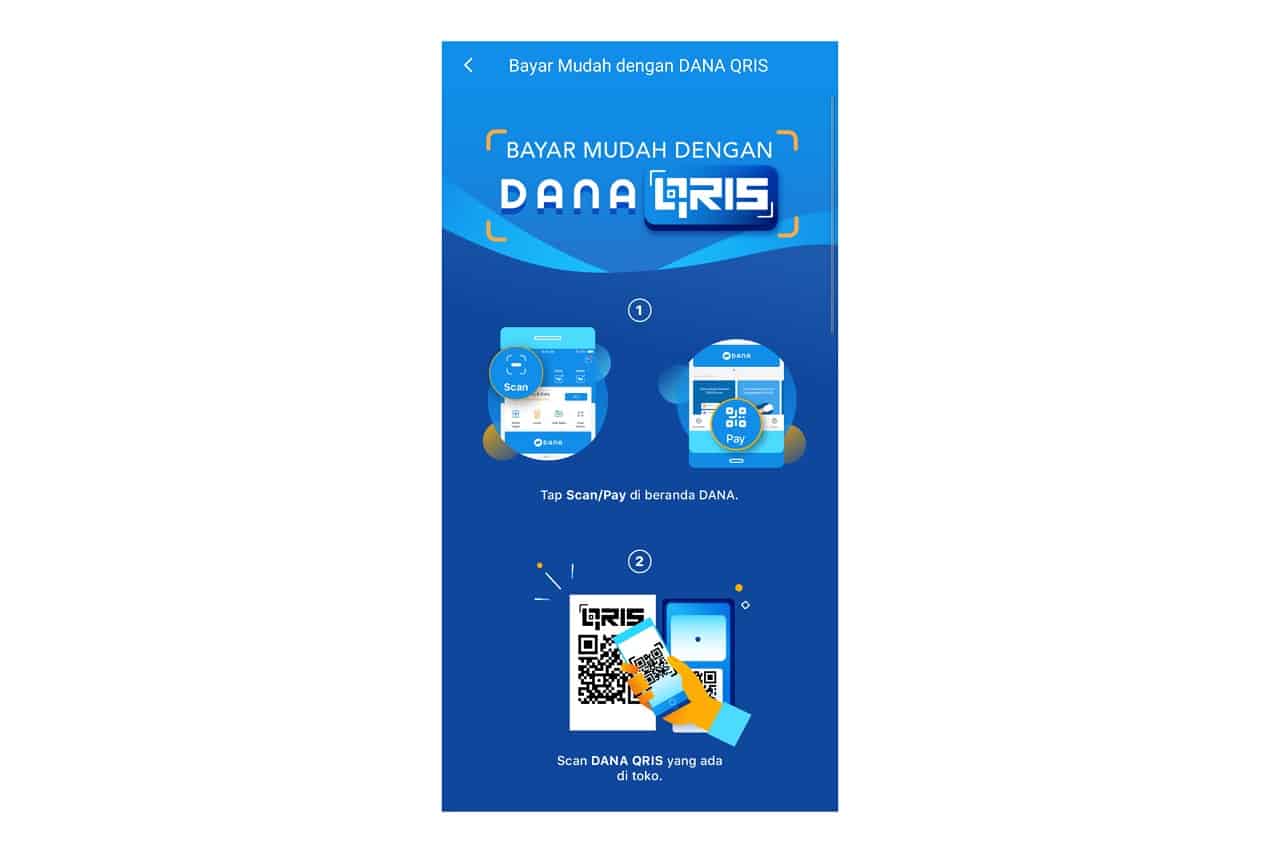

People can transact easily and safely using only their smartphone.

3. Untung (Profitable)

Transactions using QRIS can also be profitable both for buyers and sellers, because it is very efficient through one QR Code that can be used for all apps.

4. Langsung (Direct)

Transactions via QRIS can be directly carried out without spending much time. Just scan the QR Code, and your payment is done. The only requirement is that the user must have a smartphone with a camera.

For the beginning stage, QRIS focuses on implementing QR Code Payment on Merchant Presented Mode (MPM) model where the seller (merchant) can display their QR Code to be scanned by the buyer (customer) for payment transactions.